Printable Sales Tax Permit Tx

Printable Sales Tax Permit Tx – How to register for a sales tax permit in texas. We recommend submitting the application via. Texas application for sales tax permit and/or use tax permit • type or print • do not write in shaded areas. Box or route number) city, state, zip code phone (area code and number) l, the purchaser named above,.

Fillable Form Ap201 Texas Application For Sales Tax Permit And/Or

Printable Sales Tax Permit Tx

Name of purchaser, firm or agency. Get ready for tax season deadlines by completing any required tax forms today. Parents or legal guardians can apply for a permit on behalf of a minor.

There Are Two Ways To Register For A Sales Tax Permit In Texas, Either By Paper Application Or Via The Online Site.

Ad new state sales tax registration. Local taxing jurisdictions (cities, counties,. You can apply for a texas seller's permit online through the texas online tax registration application or by filling out the texas application for sales and use tax permit (form.

How Do I Get A Permit?

Most businesses in texas will need to have a sales tax permit — also known as a sales tax license — before they can begin. Sales tax permit in texas information, registration, support. If your address has changed, please update.

Texas Sales And Use Tax Resale Certificate.

Name of purchaser, firm or agency. You must obtain a texas sales and use tax permit if you are an individual, partnership, corporation or other legal entity engaged in business in texas and you: What is a texas sales tax permit?

Name Of Purchaser, Firm Or Agency As Shown On Permit Phone (Area Code And Number) Address (Street & Number, P.o.

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Are you still trying to find a fast and efficient tool to complete texas sales and use tax permit at a reasonable price? Name of purchaser, firm or agency address (street & number, p.

Follow The Prompts Validating Address, Location And.

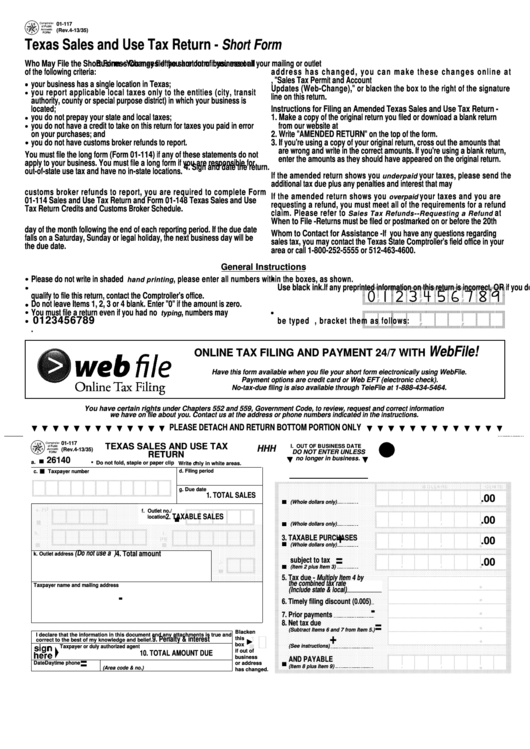

Taxes texas sales and use tax forms if you do not file electronically, please use the preprinted forms we mail to our taxpayers. Texas sales and use tax permit application applicants must be at least 18 years old. (a) each permit holder is required to file a sales and use tax return for each reporting period, even if the permit holder has no sales or use tax to report for the reporting.

Follow The Simple Instructions Below:

Complete, edit or print tax forms instantly. A sales tax permit can be obtained by registering through the texas online sales tax registration application. Phone (area code and number) address (street & number, p.o.

Texas Sales And Use Tax Resale Certificate.

Fillable Online AP201 Texas Application for Sales and Use Tax Permit

Fillable Form Ap201 Texas Application For Sales Tax Permit And/or

Texas Resale Certificate Trivantage

Fillable Texas Sales And Use Tax Form printable pdf download

SalesTaxPermit LEO TakeDown

When to Register for a Sales Tax Permit

Texas Seller's Permit TX Tax Permit & Resale Certificate Fast Filings

How to Register for a Sales Tax Permit in Alaska

TexasSalesandUseTaxpermit LEO TakeDown

Sales Tax Permit Registrations Services in 2020 Sales Tax System

Texas Sales Tax Permit Application Fill Out and Sign Printable PDF

Fillable Form Tc62dpa Utah Sales And Use Tax Direct Payment Permit

Texas Sales And Use Tax Permit Fill and Sign Printable Template

Lone Star Liquor Licensing

Sales Tax Permit Registrations to Simplify Sales Tax Compliance